Steven Alpinieri, CPA

Welcome to Steven Alpinieri, CPA! We specialize in bookkeeping, tax preparation and planning, and more to keep your finances in top shape. Our expert team is dedicated to helping individuals and businesses achieve their financial goals. Whether you're an individual or a business, we're here to provide the financial expertise you need for success. Let us handle your financial matters while you focus on what you do best.

Steven Alpinieri, CPA

Steven Alpinieri formed his own full service CPA firm in 2010. Steven previously was the assurance services partner of a long standing CPA Firm. He has been in Public Accounting since 1997. Steve also prepares complex corporate, partnership, trust, and individual tax returns. Additionally, Steven's technical expertise is performing audits, reviews, and compilations of financial statements and consulting. His experience includes work for manufactures, distributors, construction contractors, internet companies, 401 (k) audits, and non-profit organizations. Additionally, Steve has played a significant role in obtaining various federal and state credits, saving clients thousands of dollars in tax. Steven graduated with a Bachelor of Science degree from San Diego State University majoring in Accounting. He is also a member of the California Society of Certified Public Accountants.

Ready To Get Started

Click the button below to speak with us today!

Araceli Alpinieri-Vargas

Operations Manager and Co-Founder

Araceli Alpinieri, co-founder and Operations Manager at [Your CPA Firm Name], partners with Steven Alpinieri to ensure our firm runs smoothly. Araceli oversees human resources, manages and enhances office procedures and protocols, and contributes significantly to our real estate operations. Although she may not always be visible in the office, her impact is profound, as she ensures the real estate aspect of our business operates at its highest level. Her dedication to excellence keeps our firm thriving.

Ryan Sheprow

Tax and Staff Accountant Supervisor

Ryan graduated from Coastal Carolina University in 2015, and has been working in public accounting ever since.

Hunter Roginson

Associate Accountant

Hunter graduated SDSU in 2020, with a bachelor arts and business degree with an emphasis on business management. Hunter is also involved in the administration of the firm and is our Accounts Receivable specialist

Ready To Get Started

Click the button below to speak with us today!

What We Offer

Here at Steven Alpinieri CPA, we understand that when it comes to managing your finances, you need the best in the business. That’s where we come in, providing everything you need to not only stay financially sound but to thrive and grow.Services include:

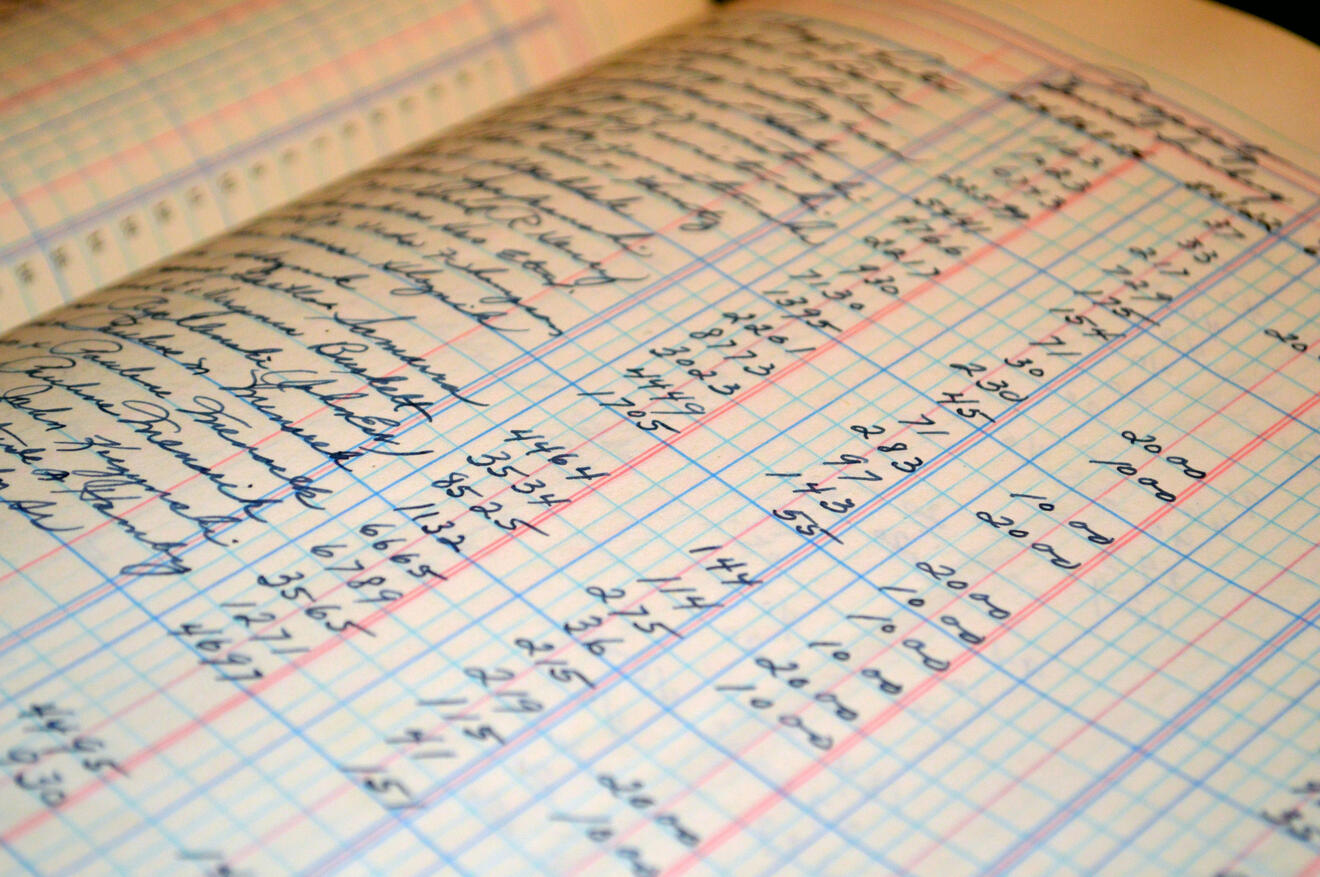

-Bookkeeping

-Tax Preparation and Planning

-And so much more!Book your free consultation today to see how we can help you and your business achieve financial success and more!

Bookkeeping

We provide bookkeeping services on a monthly, quarterly, or yearly basis. We also specialize in helping clients learn the ins and outs of bookkeeping through QuickBooks Desktop and QuickBooks Online.

Tax Preparation and Planning

We are passionate about making tax preparation a stress-free experience for our clients. With years of experience in the industry, our knowledgeable staff will work with you to ensure that you receive the tax deductions you deserve.There are a number of ways to go about tax planning. We primarily focus on the three basic methods, which include: reducing your overall income, increasing your number of tax deductions throughout the year, and taking advantage of certain tax credits.

Special Projects

We also provide many other services that relate to Tax and Accounting:- Audits, Reviews & Compilations- Sales Tax Returns- Employee Tax Retention Credit- IRS and State Notices- Personal Financial Statements- Quit Claim Deeds- Payroll services- Incorporating business entities- 1099 preparation

Ready To Get Started

Click the button below to speak with us today!

© Untitled. All rights reserved.